The gavel has fallen at the AirCarbon Exchange (ACX) in ADGM. In a historic first for the region, Abu Dhabi has successfully auctioned its first tranche of sovereign ‘Blue Carbon’ credits, and the price has stunned the global market.

For years, the “Voluntary Carbon Market” (VCM) was the Wild West of finance, plagued by low prices, phantom forests, and questions of integrity. Investors wanted to buy green, but they didn’t trust what they were buying.

In March 2026, Abu Dhabi just changed the rules of the game.

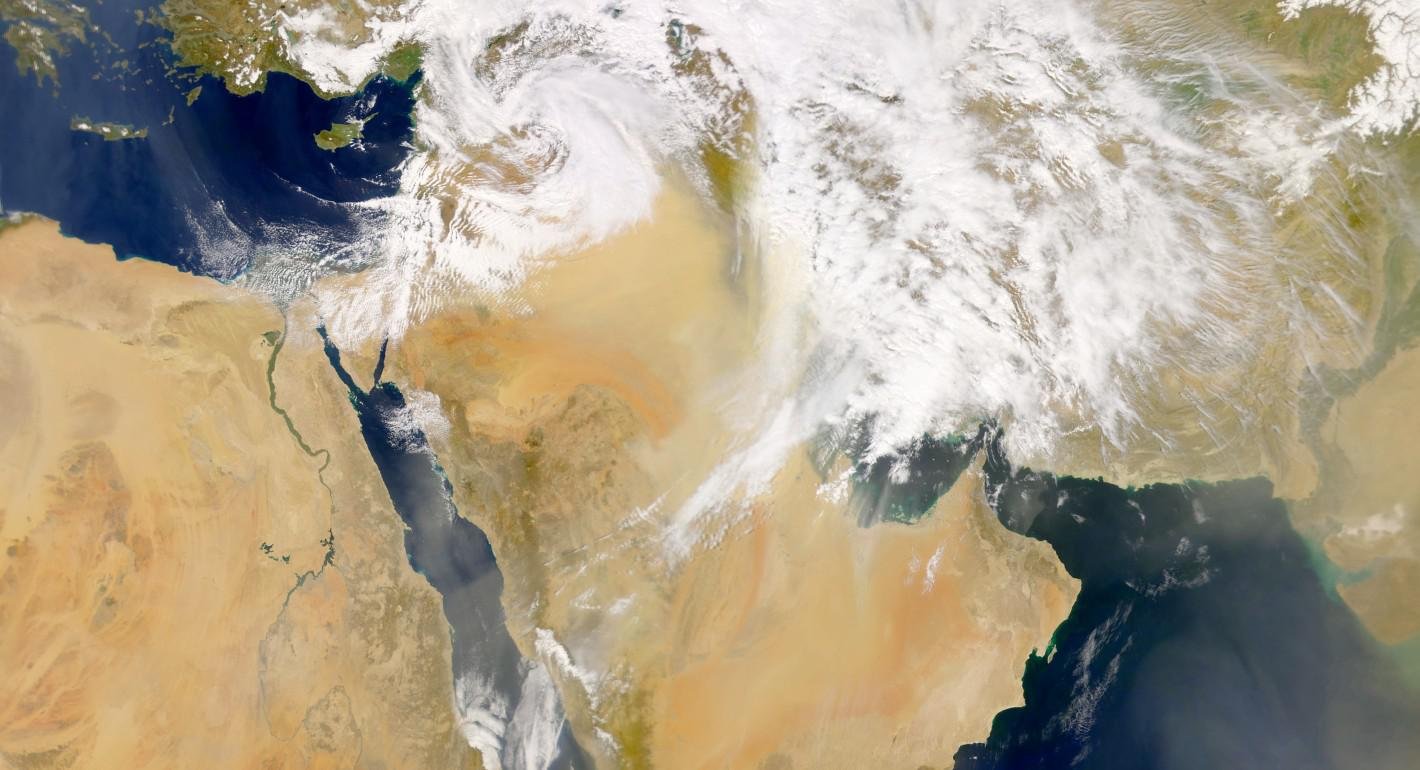

This week, the AirCarbon Exchange (ACX), located in the Abu Dhabi Global Market (ADGM), hosted the world’s first auction of Sovereign Blue Carbon Credits. The underlying asset? The millions of mangrove trees planted and protected along the UAE’s coastline under the Abu Dhabi Mangrove Initiative.

When the digital trading bell rang at 9:00 AM, analysts expected a trading range of $15 to $20 per ton. By the time the session closed, the settlement price had soared to $35.00 per ton—a premium of nearly 75% over the global average for nature-based credits.

The Auction: A “Flight to Quality”

The auction offered 500,000 tonnes of CO2 equivalent credits, developed by Blue Carbon LLC, a Dubai-based entity that has spent the last three years auditing the emirate’s coastal ecosystems.

Unlike generic “forestry credits” from unregulated projects, these units came with a “Sovereign Guarantee.” They are verified by the UAE government and tracked on a blockchain registry within ADGM’s regulated environment.

“This is a flight to quality,” says William Pazos, Co-CEO of ACX. “Global buyers—including Japanese airlines and European energy majors—are tired of ‘greenwashing’ risks. They paid a premium today because they know these mangroves actually exist. They are monitored by satellites and drones 24/7. It is the most transparent carbon asset in the world.”

Why “Blue” is the New Gold

“Blue Carbon” refers to carbon captured by ocean ecosystems like mangroves, seagrass, and salt marshes. Science shows that mangroves can sequester carbon up to four times faster than tropical rainforests.

For the UAE, this geology is a strategic asset. The Abu Dhabi Mangrove Initiative, launched with the goal of planting 100 million mangroves by 2030, has now matured into a financial engine. The trees planted in 2020-2022 are now entering their peak sequestration phase.

“We are effectively harvesting money from the sea without catching a single fish,” notes a sustainability analyst at First Abu Dhabi Bank (FAB). “By monetizing the carbon storage of our coastline, we have created a new revenue stream that incentivizes conservation. If the mangroves are worth $35 a ton alive, nobody will cut them down.”

The Buyers: Who Paid the Premium?

The bidder list for the Abu Dhabi Blue Carbon auction 2026 reads like a Who’s Who of heavy industry.

- Aviation: Two major Gulf carriers secured 30% of the volume to offset their “CORSIA” (international aviation carbon scheme) obligations.

- Tech: A US-based hyperscale data center provider (rumored to be Microsoft or Google) bought a significant tranche to offset their AI power consumption.

- Energy: European oil majors took the remainder, needing high-quality offsets to meet strict EU reporting standards.

The ADGM Advantage: Regulation Matters

The success of the auction is also a victory for ADGM, the first jurisdiction in the world to regulate carbon credits as “financial instruments” rather than just commodities.

This legal distinction is critical. It means that trading carbon on ACX comes with the same legal protections as trading Apple stock or Gold futures. There is no double-counting, and settlement is instant.

“The regulatory wrapper gave us the confidence to bid,” said the Head of Carbon Trading at a London-based commodity house. “In other markets, you worry if the credit has been sold twice. In Abu Dhabi, the custody is clear.”

The Global South Connection

Crucially, this auction is a proof-of-concept for a wider strategy. Blue Carbon LLC has signed agreements with governments across Africa (Liberia, Zimbabwe, Tanzania) to develop similar credit mechanisms.

The high price achieved in Abu Dhabi sets a benchmark. It proves that if the “Global South” can prove the integrity of their forests, the “Global North” will pay a premium for them.

“We are creating a template,” says Josiane Sadaka, CEO of Blue Carbon. “We started with UAE mangroves to prove it works. Now, we can take this financial infrastructure to Africa and Asia. We are unlocking the value of nature for the developing world.”

A New Asset Class

As the screens at ACX cooled down this evening, one thing was clear: Carbon is no longer a donation or a CSR expense. It is an investable asset class.

The Abu Dhabi Blue Carbon auction 2026 has set a floor price for high-quality nature assets. For the UAE, it is a vindication of its “Green Economy” strategy. It turns out that saving the planet isn’t just good ethics; at $35 a ton, it’s very good business.