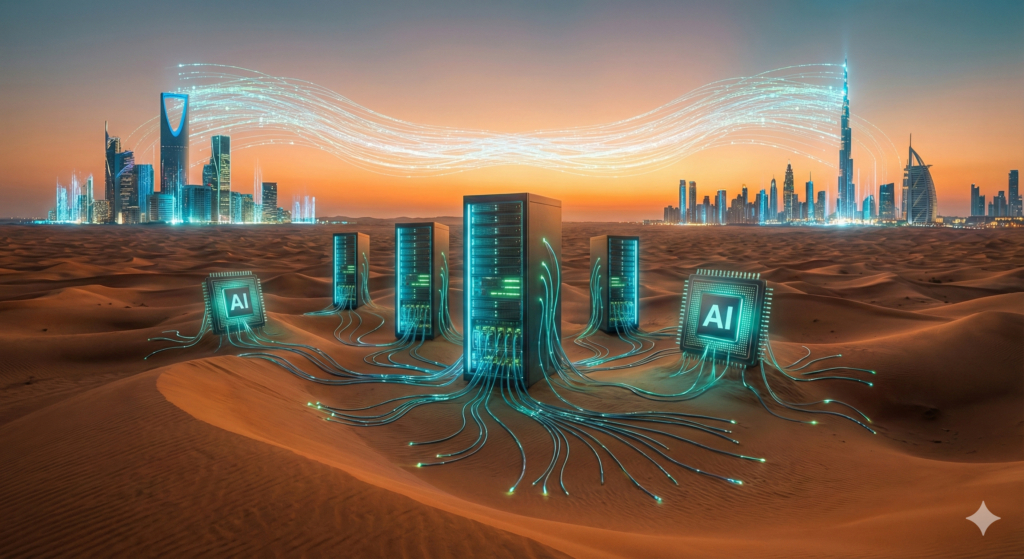

The new “oil” is compute power. As Riyadh and Abu Dhabi pour billions into data centers and GPU clusters, a fierce economic rivalry is reshaping the global digital map.

DUBAI/RIYADH — In the 20th century, power in the Gulf was measured in barrels per day. In 2025, it is measured in PetaFLOPS.

- The new “oil” is compute power. As Riyadh and Abu Dhabi pour billions into data centers and GPU clusters, a fierce economic rivalry is reshaping the global digital map.

- The Infrastructure Boom: CAPEX Kings

- The “Chip Famine” and Sovereignty

- The Regulatory Moat: Where does your data live?

- The Economic Prize

A high-stakes arms race is unfolding between the region’s two economic heavyweights, but the weapons are not missiles, they are Nvidia H100 chips and hyperscale data centers. Saudi Arabia and the United Arab Emirates are locked in a battle to become the undisputed AI capital of the Global South.

While diplomatic ties remain cordial, the economic competition is fierce. Both nations recognize that in a post-oil world, the country that controls the “Sovereign Cloud”, the physical infrastructure where data lives and AI thinks, controls the economy.

The Infrastructure Boom: CAPEX Kings

The scale of investment is staggering. According to new data from IDC and Gartner for Q4 2025, data center capacity in the GCC has doubled in the last 18 months alone.

The UAE’s Strategy: The Global Node The UAE, specifically Abu Dhabi, has positioned itself as a global connector. The pivot point was the $1.5 billion investment by Microsoft into G42 earlier this year. That deal wasn’t just about money; it was about access. It secured the UAE a priority lane for advanced chips and integrated its infrastructure with the Azure ecosystem.

“Abu Dhabi is playing a ‘Singapore strategy’,” explains tech analyst Rajiv Ghosh. “They are building a neutral, high-speed hub where East meets West. Their regulation is agile, designed to attract global hyperscalers like AWS and Core42 to set up regional HQs.”

Saudi Arabia’s Strategy: The Local Fortress Riyadh’s approach, driven by the Public Investment Fund (PIF) and the Saudi Data & AI Authority (SDAIA), is distinct: Localization. Under Vision 2030, the mandate is clear: Data generated in Saudi Arabia must stay in Saudi Arabia. This has forced global giants to build inside the Kingdom.

The result is a construction boom. Oracle, Google Cloud, and Huawei have all brought massive cloud regions online in Riyadh and Neom this year. The Kingdom is not just importing cloud services; it is forcing the supply chain to relocate.

The “Chip Famine” and Sovereignty

The bottleneck for both nations is hardware. The global shortage of high-performance GPUs (Graphics Processing Units) has turned diplomats into procurement officers.

In 2025, “Sovereign AI” requires “Sovereign Compute.” Both nations are wary of relying entirely on Western cloud providers, which could be subject to US extraterritorial regulations or sanctions.

- UAE: Is leveraging its G42 partnership to build the world’s largest AI supercomputer dedicated to climate and healthcare modeling.

- Saudi Arabia: Is reportedly in advanced talks to establish domestic chip manufacturing capabilities, aiming to move from a consumer of silicon to a producer by 2030.

The Regulatory Moat: Where does your data live?

For multinational corporations (MNCs) operating in the Gulf, this rivalry creates a complex compliance landscape.

Saudi Arabia’s Personal Data Protection Law (PDPL), fully enforced as of late 2024, imposes strict residency requirements on “sovereign” and “sensitive” data. This effectively creates a “digital border.” Banks, healthcare providers, and government contractors must host their workloads on servers physically located within the Kingdom.

This has created a “split-stack” reality for businesses. “We can no longer run the Middle East from a single server in Dubai,” admits the CTO of a major regional logistics firm. “We now have to maintain a Saudi stack and a UAE stack. It increases costs, but it is the cost of doing business in a bifurcated digital market.”

The Economic Prize

The stakes could not be higher. PwC estimates that AI could contribute $320 billion to the Middle East’s economy by 2030. The nation that captures the lion’s share of this, by hosting the models, training the algorithms, and owning the data, will dominate the region’s GDP for the next fifty years.

Investment Outlook:

- Short Term (2026): Expect a surge in IPOs for “picks and shovels” companies, construction firms specializing in data center cooling, fiber optic cabling, and energy management.

- Long Term: The winner will be determined by energy. Data centers are power-hungry. The nation that can provide the cheapest, cleanest Green Energy (nuclear in UAE, solar in KSA) to power these AI brains will ultimately win the war of margins.

For now, the race is neck-and-neck. The UAE has the head start in partnerships, but Saudi Arabia has the scale and the sheer capital force. The winner? The digital economy itself.

Share this analysis: Are you navigating the new data sovereignty laws? Share this briefing with your CIO. @TheTelegraphME #TechTrends #SaudiUAE